One of only 4 CDFIs in all of East Kentucky, Redbud Financial Alternatives provides fair loans, develops new financial products based on our community’s needs, and offers financial coaching/education.

Our mission is to help our clients transform their credit from an obstacle to an opportunity.

Financial stability is about more than your credit score – it’s about your life. Whether it’s purchasing a home, advancing your education, or paying monthly bills, you have a goal in mind and we are here to help you reach it!

Redbud provides an alternative to predatory lenders that take advantage of individuals, families, and communities facing hard times. We help our clients:

Redbud also fosters, facilitates, and promotes economic development among underserved populations by building the financial capability of our community members.

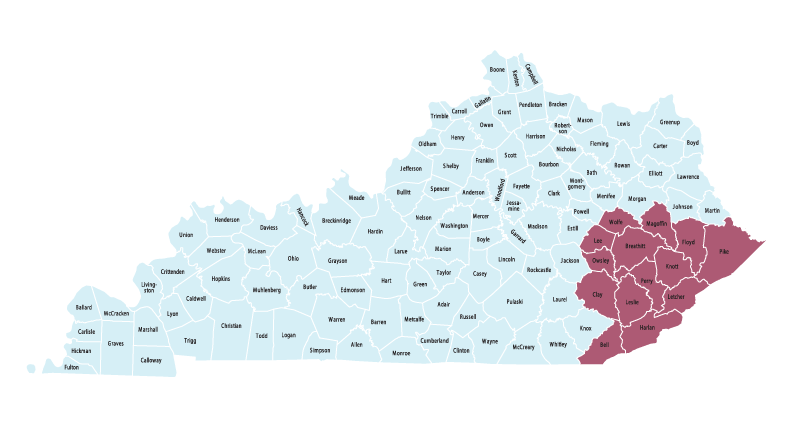

Redbud's services are available to individuals and families living in Breathitt, Knott, Leslie, Perry, and surrounding counties in East Kentucky.

High-cost and/or payday loans are one of the most debilitating forms of credit. Our Emergency Loan refinances that debt at an affordable interest rate! This loan will pay off a payday loan and allow you to escape from its "cycle of borrowing." Redbud Emergency Loans are $500 loans paid in $50 monthly installments from your checking account over 12 months. Redbud reports to the credit bureau, so your on-time payments will help build your credit score!

A Redbud Personal Loan can help you with repairing a car, making a large purchase, taking a meaningful trip, or whatever else it is you are trying to accomplish! In addition, homeowners through Redbud's affiliate, Housing Development Alliance, can access a personal loan to make home repairs. This loan is designed to help you affordably finance needed repairs, keeping both your home and wallet safe.

With this loan, you can escape multiple debts by refinancing them into one affordable monthly payment! Redbud’s Debt Consolidation Loan pays off high-cost credit cards and personal finance loans and refinances the balance into a single payment made monthly. On average, our clients save about $1,250 on interest and fees!

In East Kentucky, a reliable vehicle can make all the difference! Whether you’re looking to buy a new car or refinance an existing car loan that is charging too much in interest and fees, Redbud’s Auto Loan can help. We provide a free credit review and will help you understand how much you can borrow before you shop for your automobile.

We offer a FICO Score Open Access Program for Credit & Financial Counseling - you don't even have to be applying for a loan!

Learning how to manage your finances, make informed decisions about borrowing money, and monitoring your credit are all essential to making credit something that works FOR you, not against you.

At Redbud, we offer financial coaching to help you create a strategy for achieving financial stability, setting and reaching financial goals, and building credit.

We conduct individualized educational credit reviews. (Remember: you don't have to be applying for a loan to receive this service!) In this review, we will go through each line of your credit report to identify which financial habits are helping and which are hurting your progress toward your goals.

If you're ready to get started on a path to financial wellness, give us a call at 606-716-6100!

If you see a loan or service offered by us that is right for you and your situation, simply:

Our loan officers are ready to assist you. Just give us a call at 606-716-6100 today or email us. If you email us or leave a voice message, we will contact you within 1 business day of receiving your message.

Email Us

James Caudill, Managing Director

Office: 606-716-6100, ext. 104

Timothy Baker, Director of Lending

Office: 606-716-6100, ext. 103

Joy Howard, Credit Counselor

Office: 606-716-6100, ext. 102

Trista Hill, AmeriCorps Direct Service Member

Office: 606-716-6100, ext. 101

Every East Kentucky family deserves a home they can afford. Help us transform lives through affordable housing!

Want to be a part of HDA? Sign up for our Email List to get news and exclusive updates, info on local and regional volunteer opportunities, timely reminders about events and fundraising activities, details on how to donate, how to receive our newsletter, and more!

© 2021 – Housing Development Alliance | Designed by The Holler

If you would like to take part in HDA’s traditional Volunteer Program, our Ultimate House Raising Challenge, or in providing Flood Disaster Recovery, please fill in your details below.

Shortly after the form is received, our Volunteer Coordinator will reach out to you. If, for some reason, you haven’t heard from us within a week of submitting the form, please call us at 606-436-0497.

Please Note: This is just an inquiry form. There are more forms you must fill out, sign, and send to us before the process is completed. So, let’s get started!

"*" indicates required fields

Sign up now to participate in one or both of our special Days of Service in remembrance of last year's devastating flood.

"*" indicates required fields

Please fill out this contact form and let us know what kind of help you need. A member of our staff will contact you ASAP.

"*" indicates required fields